Creating a Modular Tax Calendar System with Microsoft Dataverse

The preceding blog, "Tax Compliance: Automate Your Tax Calendar" introduced the concept of leveraging automation to enhance tax compliance strategies. It provided a foundational understanding of the potential benefits and efficiencies that can be realized by integrating automated solutions into tax management processes. Building on that conceptual groundwork, our upcoming blog, "Creating a Modular Tax Calendar System with Microsoft Dataverse," will delve deeper into the technical aspects, focusing on developing a scalable, adaptable database. This sequel will pave the way for future discussions on automation, set to be covered in subsequent post.

Schema Design

Designing an effective schema in Microsoft Dataverse involves creating a set of tables (entities) that are interconnected, ensuring that the data is structured and accessible. The schema for our tax calendar system includes the following key tables:

Entity Table:

Contains records of the business entities.

Fields: Entity ID (primary key), Name, Address, Code, Directors, Country of Residence.

The Entity ID serves as a unique identifier for each record, facilitating a clear linkage with other tables.

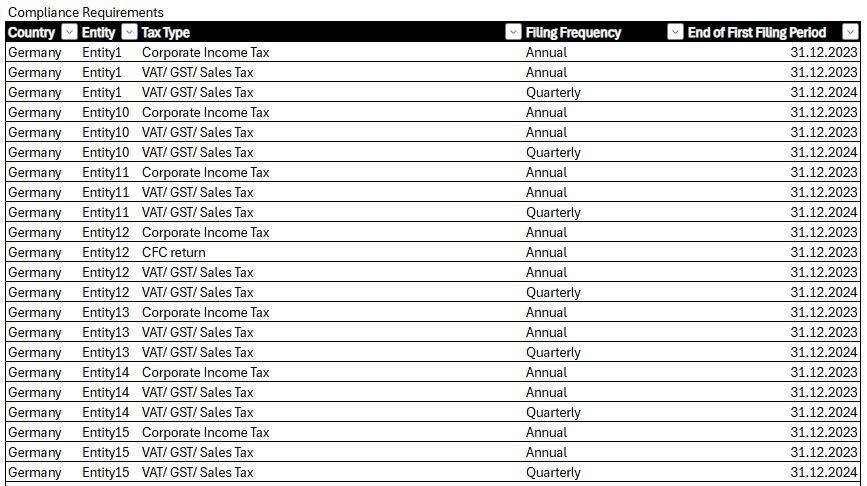

Tax Compliance Table:

Holds the compliance requirements for each entity.

Fields: Compliance ID (primary key), Entity ID (foreign key), Tax Type, Frequency of Filing, End Date of First Filing Period.

The Entity ID establishes a many-to-one relationship with the Entity table, connecting each compliance record to its respective entity.

Tax Calendar Table:

Stores the scheduled tax filings for each entity.

Fields: Calendar ID (primary key), Entity ID (foreign key), Filing Deadline, Filing Status, Tax Type, Period.

This table uses the Entity ID to link back to the Entity table, ensuring that each filing is accurately associated with the correct entity.

Deadline Matrix Table:

Provides a reference for filing deadlines based on country and tax type.

Fields: Matrix ID (primary key), Country, Tax Type, Frequency of Filing, Day-Month.

Although this table may not directly link to the Entity table, it serves as a crucial reference for determining filing deadlines.

Entity Relationships

The relationships between tables in Microsoft Dataverse are fundamental to maintaining a coherent data structure. They enable the system to reflect real-world associations between different pieces of data. For our tax calendar system, the relationships are as follows:

The Tax Compliance table has a many-to-one relationship with the Entity table, as multiple compliance records can be associated with a single entity.

The Tax Calendar table also has a many-to-one relationship with the Entity table, linking each tax filing event to its entity.

The Deadline Matrix table, while indirectly related, supports the other tables by providing necessary deadline information for compliance planning.

Data Integrity

Ensuring data integrity is crucial in a system managing financial compliance, as inaccuracies can lead to severe consequences like missed deadlines or regulatory penalties. In Microsoft Dataverse, data integrity is maintained through:

Validation Rules: Implementing validation rules ensures that only valid data is entered into the system. For instance, you can set rules to verify that dates are in the correct format and that mandatory fields like the Entity ID are not left blank.

Cascading Policies: These are essential for maintaining referential integrity. For example, if an entity is deleted, you might want the associated compliance records to be automatically deleted (cascade delete) or prevent the deletion if related records exist (restrict).

By carefully designing the schema, defining the relationships, and implementing mechanisms to maintain data integrity, you can build a highly effective tax calendar system in Microsoft Dataverse. This system will not only streamline the tax compliance process but also scale with your organization's needs, accommodating additional data sets and functionalities as required. In the next sections of our tutorial, we'll explore how to implement custom business logic, automate workflows, and integrate with other systems to further enhance the capabilities of your tax calendar system.