Digital Transformation in Claims Management: The What, Why and Where

Claims Management: Embracing Digital Transformation

Claims Management Across Project-Based Industries

Claims management stands as a critical function within project-based industries, where it plays a vital role in addressing disputes that arise from project delays, cost overruns, and discrepancies in quality or contractual commitments. The principles and challenges of claims management extend across various sectors, including technology, healthcare, and infrastructure development.

What Is Claims Management?

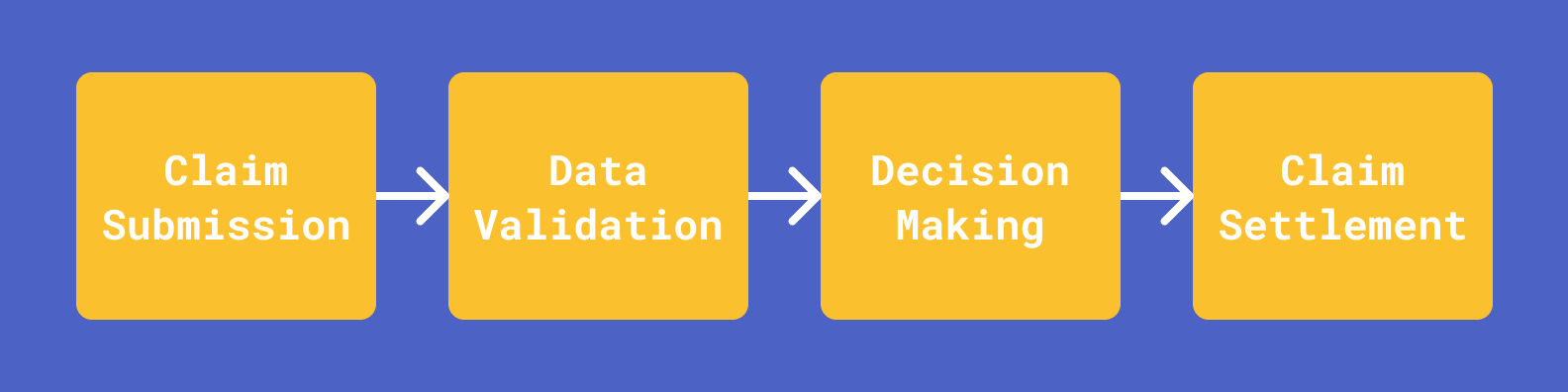

At its core, claims management is a meticulously structured process tailored to efficiently address and resolve disputes. This process encompasses several key steps:

Claim Submission: Initiating with the identification and detailed submission of a claim, which outlines the background, contractual basis, and specifics related to cost and project execution.

Data Validation: This stage focuses on verifying the accuracy of the submitted claim, ensuring comprehensive documentation and adherence to contractual requirements.

Decision Making: With the data validated, a crucial analysis is undertaken to ascertain the claim's validity, leveraging the gathered documentation and contractual agreements.

Claim Settlement: The final phase aims to reach an equitable settlement, resolving the claim in a manner that prevents further disputes and aligns with project objectives.

Why Improve Claims Management?

The traditional methods of managing claims—marked by manual operations and fragmented processes—pose significant challenges. These methods are not just outdated; they're inefficient, leading to higher costs and dissatisfaction among stakeholders.

Extended Lag Time: The time it takes from filing a claim to its resolution is unnecessarily long, impacting both customer satisfaction and operational efficiency.

Lack of Accountability: With many hands touching a claim throughout its lifecycle, it's often difficult to pinpoint responsibility, leading to blame games and further delays.

Communication Gaps: Essential information often gets lost in translation between departments, delaying the claims process.

Manual Processing: The reliance on human intervention for data preparation and analysis slows down the claims handling process significantly.

Repetitive Data Tasks: The nature of traditional claims management involves a lot of data entry and re-entry, consuming valuable time that could be spent on analysis.

Disjointed Workflows: Fragmented processes lead to longer claim cycles and reduced efficiency, affecting overall productivity.

These inefficiencies aren't just operational headaches—they translate into tangible financial losses. The direct and indirect costs associated with slow, manual, and disjointed claims management can significantly impact a company's bottom line. It's clear that sticking with outdated methods is not just inefficient; it's expensive.

Where are the Opportunities for Digitalization and Automation?

From straightforward data validations with dropdowns to advanced OCR and machine learning for information extraction, the claims management landscape is ripe with opportunities for technological enhancement and optimization.

Data Collection

Online Claims Portal: Utilize an online portal for claim submissions to make the process more user-friendly and efficient.

Include simple data validations such as drop-down menus for form fields, email verification, currency selection, and currency conversion.

Database Utilization: Store submission data in a database to simplify information querying and enhance the speed and accuracy of claims processing.

Data Integrity and Backups: Ensure data integrity through regular backups and snapshots, facilitating easy recovery and historical data analysis.

Document Management

Document Organization: Implement systems to automatically create a specific folder structure for each new claim, organizing claims data electronically to avoid manual processes.

Document Tagging: Enhance document retrieval by tagging them with relevant identifiers.

Optical Character Recognition (OCR): Use OCR and machine learning algorithms to validate submitted documents against project records and extract relevant information based on predefined models.

Data Structuring and Analysis: Once data is extracted, structure it for efficient retrieval, analysis, and integration with other business processes.

Workflows

Claims Routing and Processing: This involves the integration of claims data with workflow systems to automate the routing for review, approval, and other necessary steps. It significantly reduces manual handling and speeds up the claims management process.

Rules-Based Escalation and Auto-Settlement: Establish automatic escalation for claims exceeding certain amounts and enable automated settlements for lower-value claims. This approach ensures efficient prioritization and handling of claims based on their complexity and value.

Communication

Notifications: Send automated updates to claimants about their claim status, additional information requests, or decision notifications, enhancing transparency and satisfaction.

Conclusion

By adopting digital tools and automation, companies can fix the slow and outdated parts of traditional claims handling. From simple data entry improvements to complex analysis with AI and OCR, these changes make processes faster and more transparent, making everyone involved happier. In our next blog posts, we'll look at how tools like Microsoft Power Platform and other easy-to-use software can transform the way claims are managed.